They must totally distribute the account in one decade or face prospective penalties of 10 to 25 percent. While distributions and withdrawals will be strained at your regular rate, they will not undergo the 10 percent early withdrawal cost– also if you have not gotten to old age. When you understand the individual retirement account is coming your method, there’s an excellent factor to take note of the schedule. If your partner was required to take a payout called a required minimum circulation (RMD) in the year they died yet did not yet take it, you’ll need to do so.

Mirror Wills Vs Common Wills

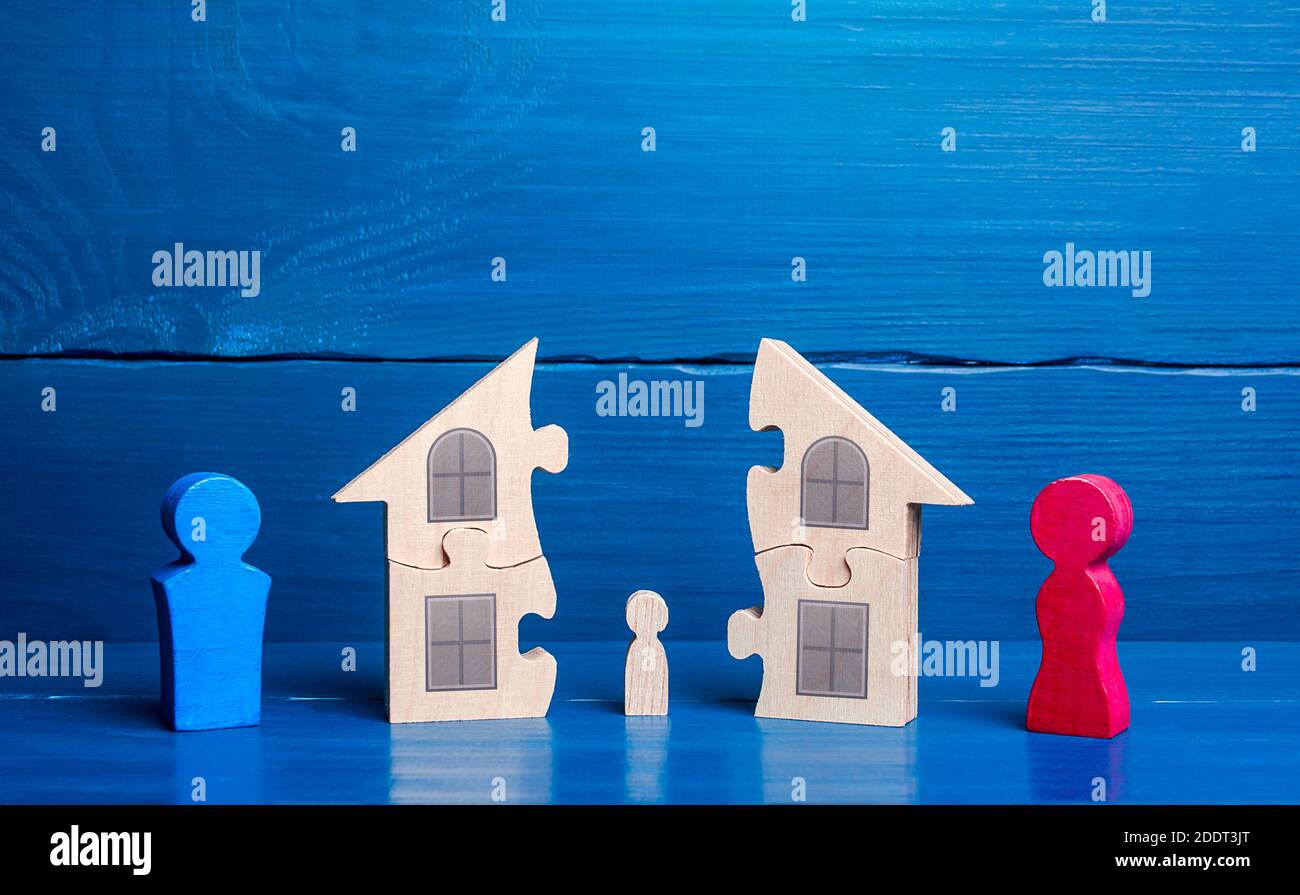

This implies your spouse can upgrade their will, such as changing the administrator or altering various other provisions, without requiring your authorization. Mirror wills are not legitimately binding on either party, enabling independent adjustments to be made any time. For instance, an important asset such as residential or commercial property might end up being jointly owned by your children from a previous marital relationship and your new spouse/civil companion.

It goes without saying, most individuals become part of mirror Wills with the expectation that they have some certainty regarding who will certainly inherit their estate. It produces a belief that not only have they protected the passions of their partner, by naming them as the main beneficiary, but that their kids will certainly still profit financially eventually in the future. Regardless of the dissolution of marital relationship, ex-spouses may maintain particular legal rights to property held throughout their union. Nevertheless, this does not always assure that those exact same things would automatically be acquired. There might be recipient classifications or joint accounts that need to be upgraded. That is why, along with updating your will certainly after you remarry, it is essential to examine your various other properties and residential or commercial property to see how they are labelled and update them appropriat

This Thesaurus Meanings Page Includes All The Feasible Significances, Example Use And Translations Of The Word Can

You additionally utilize could have to say that there was an opportunity of something holding true in the past, although it was not in fact real. You use could have to say that there is an opportunity that something was true in the past. Do not utilize ‘could not’ to say that there is an opportunity that something is not real. Rather you make use of could not or might not. You make use of could to claim that there is an opportunity that something is or will certainly hold true.

These words are used to talk about ability, recognition, and possibility. They are also made use of to state that someone has consent to do something. These uses are handled independently in this entry. You use a future form of be able to to talk about ability in the future. The use of can to ask or give permission has actually prevailed considering that the 19th century and is well established, although some analysts feel might is better suited in official contexts. May is relatively rare in adverse buildings (mayn’t is not usual); can not and can not are usual in such conte

You utilize can or a previous form of be able to to talk about capability in the past. Might is additionally utilized to speak about capability in the present, but it has a special definition. If you say that someone can do something, you suggest that they have the ability to do it, however they do not as a matter of fact do it. Can, could, and have the ability to are all made use of to talk about an individual’s ability to do something.

You utilize can or a previous form of be able to to talk about capability in the past. Might is additionally utilized to speak about capability in the present, but it has a special definition. If you say that someone can do something, you suggest that they have the ability to do it, however they do not as a matter of fact do it. Can, could, and have the ability to are all made use of to talk about an individual’s ability to do something.

Word Background

These words are used to speak about capability, understanding, and possibility. They are likewise used to say that a person has approval to do something. These usages are taken care of individually in this entrance. You utilize a future form of have the ability to to discuss capacity in Read the Full Write-up future. Making use of can to ask or grant permission has actually been common considering that the 19th century and is well developed, although some analysts really feel may is better suited in formal contexts. May is fairly rare in adverse building and constructions (mayn’t is not typical); can not and can’t are normal in such conte

This kind of strategy calls for careful consideration and understanding of its pros and cons. This complexity requires mindful planning and expertise to prevent blunders that could cost you in the long run. Once you move possessions to an APT, they no longer come from you personally. While it provides protection, research by the staff of Amazonaws comprehending costs and lawful requirements is vital prior to choosing to develop

This kind of strategy calls for careful consideration and understanding of its pros and cons. This complexity requires mindful planning and expertise to prevent blunders that could cost you in the long run. Once you move possessions to an APT, they no longer come from you personally. While it provides protection, research by the staff of Amazonaws comprehending costs and lawful requirements is vital prior to choosing to develop

A partner can revoke or alter their Will certainly at a later date and alter their desires, as an example, if they remarry or on the death of their partner, where they can alter their beneficiaries tota

If your family member died in your home under hospice treatment, a hospice nurse can proclaim them dead. Without an affirmation of fatality, you can not intend a funeral, a lot less deal with the deceased’s legal events. If there is no contingent beneficiary, the end result depends upon various other instructions in the file or state legislation. The property may be rerouted to other named beneficiaries or come under the residuary estate. When an assigned beneficiary has passed away, the question of that receives the inheritance is a common issue. The resolution depends upon the specific lawful file entailed, the timing of the deaths, and applicable state regulations.

Yet if your spouse passes away prior to you, the youngsters (as contingent beneficiaries) would certainly step in. In the truths of the 2010 Weinberger v. Morris The golden state appellate court decision, a mom left her entire depend on estate to her surviving child and completely disinherited her child. During the four year really drawn-out trust administration following the mommy’s death, the child as successor trustee ignored to distribute the possessions to herself before she too died. The mom’s trust fund, nevertheless, called her daughter’s fiancé as both the alternative follower trustee and the different recipient of any type of undistributed inheritance.

And when life-altering events take place while you’re still living, you must upgrade your will accordingly to ensure your true final wishes are satisfied to the letter. Second, the count on may name a different recipient of the moms and dad’s very own picking to receive the daughter’s undistributed inheritance. As an example, the parent’s count on could say that any kind of undistributed amount mosts likely to the little girl’s siblings. This would avoid the daughter from managing that acquires her remaining share. If he had a revocable living depend on, then he likely will additionally have a “pour-over will,” which “pours” everything over in the estate to the revocable living trust. However, there are instances where probate of a little estate is required, due to the decedent’s financial obligations or identifying that is entitled to obtain a section of the estate.

An estate strategy should be flexible adequate to adjust to life’s uncertainties, including the unanticipated passing away of a beneficiary. By including clear contingencies and comprehending inheritance regulations, you can make certain that possessions pass successfully to the designated successors without unnecessary legal obstacles. Marking contingent recipients is a crucial part of thoughtful estate preparation.

Without any will, the son’s heirs inherit according to the legislations of intestate sequence. Crafting a will certainly or making an estate plan is a liable decision that provides you regulate over how you desire your property and assets distributed after your passing. Most people compose an estate plan believing the recipients they name will certainly outlast them. So as an example, mean Tom, Penis and Harry are named as recurring beneficiaries, and each are to acquire an equivalent share of the estate. If Harry predeceases the testator, his share of the residuary estate would be divided equally in between Tom and C